In the world of real estate, timing is often the key to securing the best deals. Homebuyers, especially those on the fence about making a purchase, may be tempted to wait for interest rates to drop before taking the plunge, and for many people the magic number is 5% or less. However, aside from the obvious benefits like building equity and tax benefits, there are compelling reasons why waiting for rates to go down might not be the best strategy. (I know, a Realtor suggesting you should buy now is nothing new, but hear me out!)

The Mortgage Banker’s Association now predicts that you’ll have to wait until the fourth quarter of 2024 for the 30-year fixed rate with fall to 5%. During the next year appreciation is expected to be anywhere from 1% to as much as 7.2% depending on where you live in MN, so on a $450,000 house you could pay up to $32,000 more by waiting. In addition, when interest rates drop mortgages become more affordable, lowering monthly payments and allowing buyers to qualify for larger loans. This stimulates demand; more buyers will enter the market, and the increased competition will push prices even higher. So, while lower mortgage rates make borrowing money more affordable, a drop to 5% isn’t likely to eliminate the affordability challenges for many prospective buyers. In essence, you’ll pay more for the house and less to borrow the money.

Think back to 2020 and 2021. Interest rates were at an all-time low. Even with slightly lower inventory than we currently have on the market, buyers had to waive inspections, offer 10-20% more than the list price, and basically let sellers dictate all the terms of an offer to get it accepted. In the current market, most sellers don’t balk at the request for a thorough inspection, most homes are selling at or slightly under the asking price, and multiple offer scenarios are much less common.

So, is it better to pay a higher price for the house or a higher interest rate on the mortgage? Once you close you can never re-negotiate the purchase price. The house is yours, and you owe what you owe, but you can always refinance the interest rate when rates go down again. In recent conversations with buyers, I have suggested that it’s better to buy when prices are less inflated and refinance as soon as rates drop in order to avoid overpaying for a home.

Is it Possible to Get a Good Price AND a Lower Interest Rate?

What many of the buyers sitting on the fence don’t know is that you can get mortgage right now with an interest rate of 2-3% less than the current rate. It’s called a Temporary Rate Buydown, and many sellers are willing to pay the fees for this buydown in order to get their properties sold.

What is a Temporary Rate Buydown?

At its core, a temporary rate buydown is a financing arrangement designed to make homeownership more affordable for buyers. It involves a financial contribution, often made by the seller or builder, to lower the interest rate on a mortgage loan for a predetermined period. This temporary reduction in interest rates results in lower monthly mortgage payments for the buyer during the specified timeframe.

How Does It Work?

Temporary rate buydowns are typically structured as 2-1 or 3-2-1 buydowns, although other variations exist. Let’s break down what these numbers signify:

The First Number (e.g., 2 or 3): This represents the number of percentage points by which the interest rate will be reduced in the initial year. For example, in a 2-1 buydown, the interest rate will be 2 percentage points lower than the prevailing market rate during the first year.

The Second Number (e.g., 1): This denotes the number of percentage points by which the interest rate will be reduced in the second year. In the case of a 2-1 buydown, the rate will be reduced by 1 percentage point in the second year.

The Third Number (e.g., 0): This is the number of percentage points by which the interest rate will be reduced in the third year.

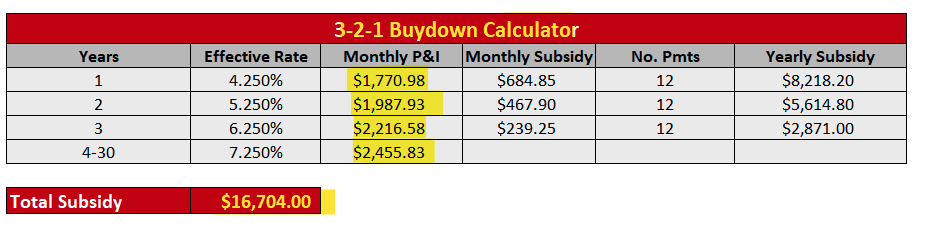

For example, if the purchase price was $450,000, the buyer put 20% down, and the current interest rate was 7.25%, the payment schedule below would apply.

Courtesy of Guaranteed Rate Affinity Mortgage

Advantages For Buyers

Temporary rate buydowns can be an enticing proposition for homebuyers, especially in a market where interest rates are relatively high. Here’s why:

Lower Initial Payments: Buyers can enjoy lower monthly mortgage payments during the first few years of homeownership, making it easier to manage their finances during the crucial initial period and making homeownership more attainable for buyers who might otherwise be on the cusp of affordability.

Purchasing Power: With lower monthly mortgage payments, buyers may qualify for a larger loan, enabling them to consider properties that might have been out of reach otherwise.

Stability: The predictability of payments during the initial years provides a sense of financial stability, allowing buyers to better plan their budgets and long-term financial goals.

Flexibility: If rates fall below your scheduled rate according to the buydown, you can still refinance and get the lower rate.

If you’ve been dreaming of a new home, let’s talk! I’d love to help you make an informed decision based on your big picture. A temporary buydown may be the answer to get you into the home you want now at an interest rate you can live with!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link